Banked's Payments API enables you to accept secure, fast, and cost-effective account-to-account payments directly from your customers' bank accounts to yours.

This guide will walk you through:

- Key Benefits: Understand the advantages of using Banked's Payments API

- Payment Types: Learn about the different payment types supported

- Single Payments: Explore one-off payments (Pay-ins) and their flow

- Recurring Payments: Discover how to set up recurring payments using mandates

Key Benefits

- Lower Transaction Costs: Significantly reduce payment processing fees compared to card payments

- Faster Settlement: Payments typically settle within minutes, not days

- Reduced Fraud: Payments are authenticated directly through the customer's bank

- No Chargebacks: Bank-to-bank transfers cannot be disputed like card payments

- Better Conversion: Simplified checkout flow improves customer experience

Payment Types

Banked's Payments API supports two main payment types:

Single payments and recurring payments are also collectively known as Pay-ins.

Each payment type is designed to meet different business needs, from one-off transactions to recurring billing.

Regional Payment Methods

| Region | Payment Method | Settlement | Account Format | Availability | Payment Types |

|---|---|---|---|---|---|

| AU | PayTo via New Payments Platform (NPP) | Real-time via NPP | BSB + Account Number / PayID | 24/7 | Pay-ins, Mandates |

| UK | Open Banking APIs | Faster Payments (instant) | Sort Code + Account Number | 24/7 | Pay-ins |

| EU | PSD2 compliant APIs | SEPA Instant (where available) | IBAN | Varies by institution | Pay-ins |

Contact Banked support at support@banked.com for availability and requirements in additional regions.

Single Payments

One-off, immediate payments that provide a secure, fast, and cost-effective alternative to traditional card payments. Perfect for e-commerce checkouts, invoices, and immediate transfers.

Available in the UK, EU, and Australia.

Single Payment Flow

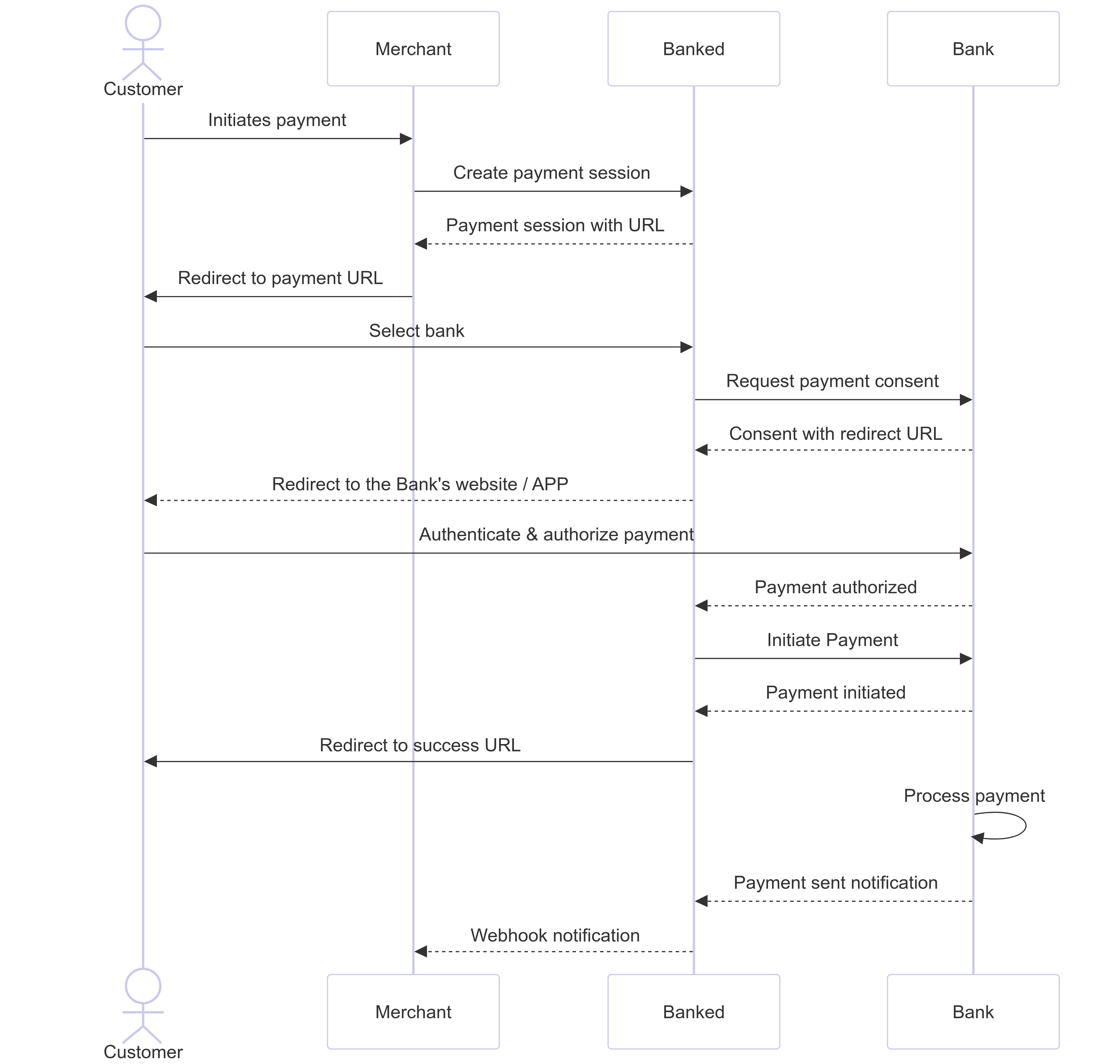

UK & EU Single Payment Flow:

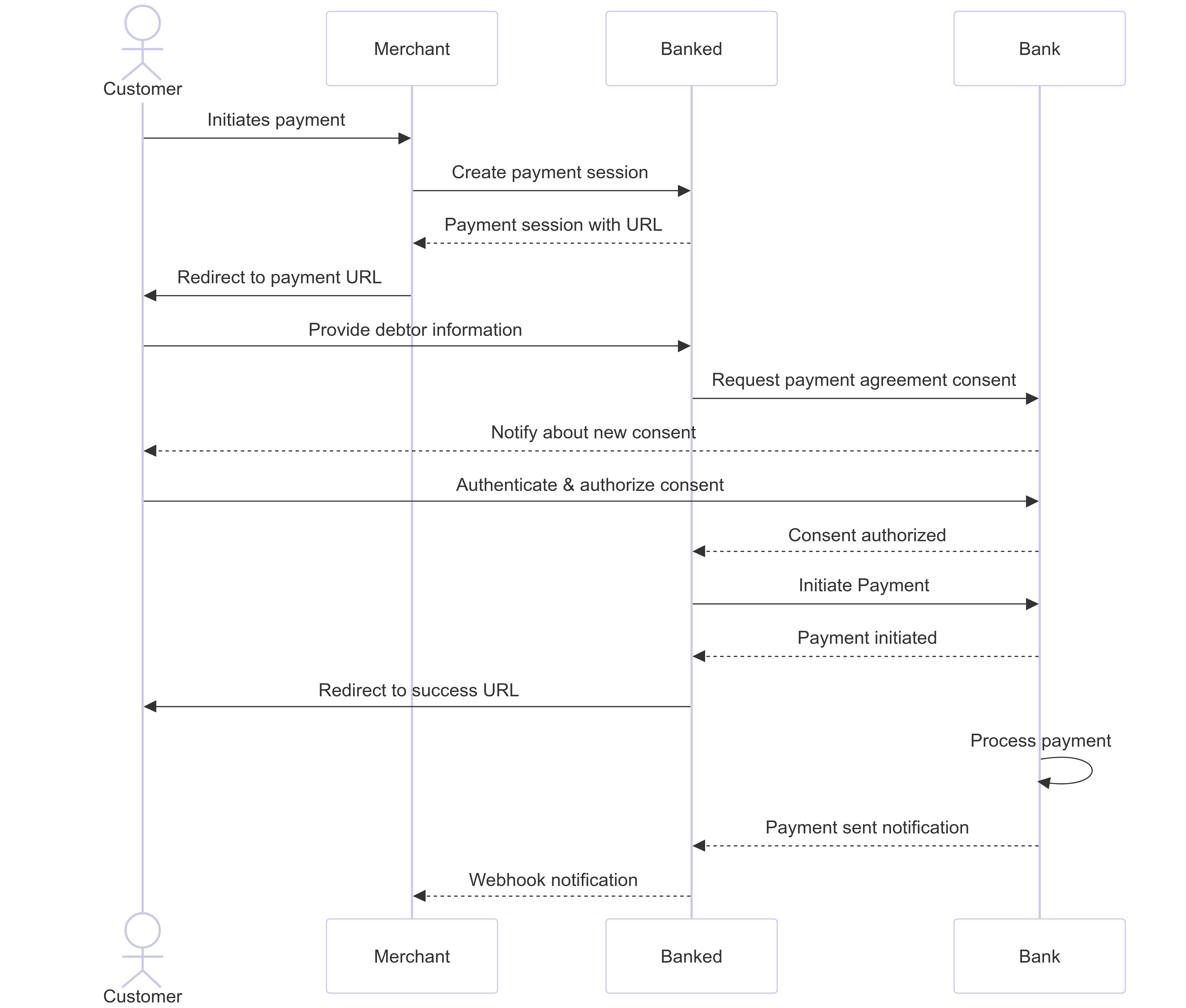

Australia Single Payment Flow:

Single Payment Authentication

Authentication for pay-ins is handled through the checkout process. Explore the different customer authentication options:

Recurring Payments

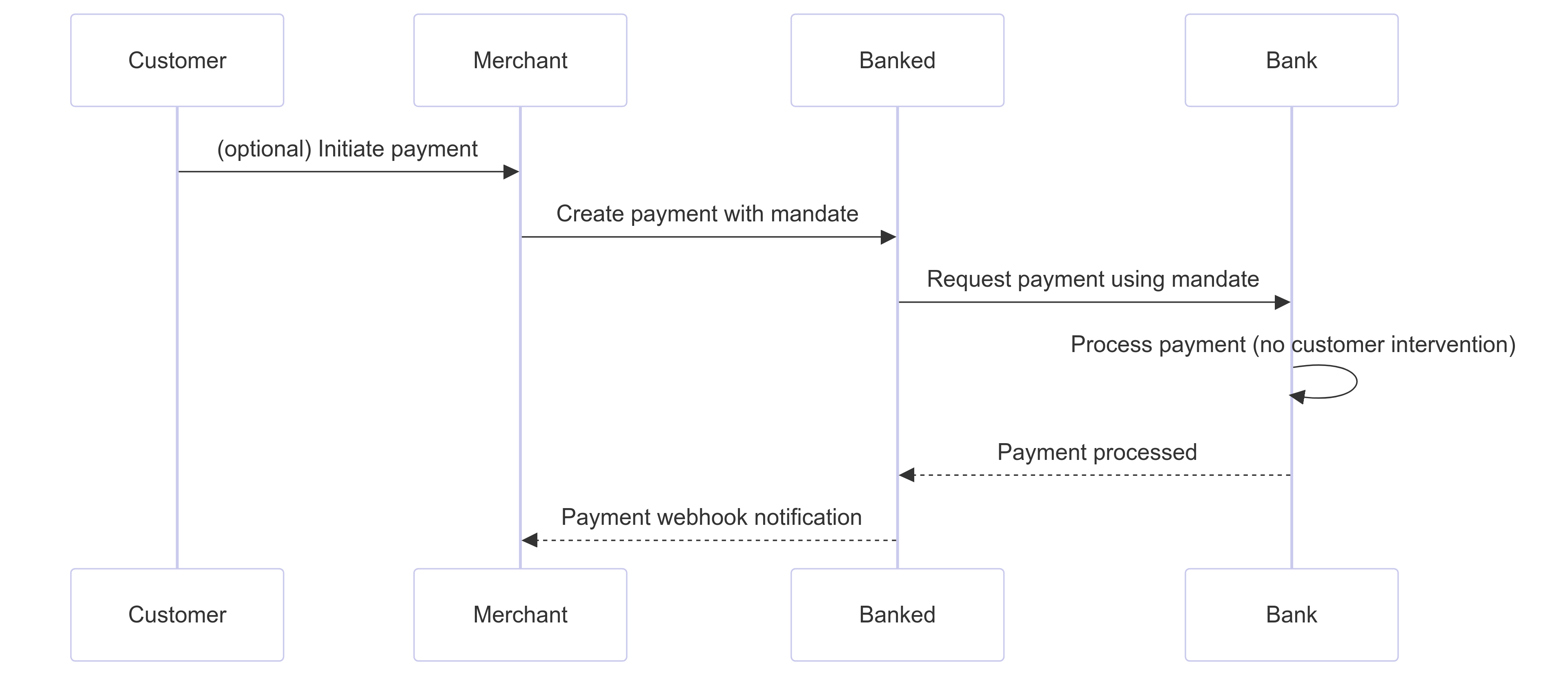

Recurring payments is where multiple payments can be triggered against one PayTo agreement and this is done with our mandates API. These payments are processed immediately using a pre-authorized mandate. User interaction is not required for each payment. Recurring payments is ideal for:

-Subscriptions, memberships, and recurring billing

-Account on File for eCommerce

Currently available in Australia, with additional regions coming soon.

Recurring Payment Flow

A prerequisite for recurring payments is an active mandate. Check out our Mandates Overview for details on setting up and managing mandates.

Recurring Payment Authentication

Authentication for recurring payments is handled through the mandate setup process. Once a mandate is created, payments can be processed without further user interaction.

Getting Started

Ready to integrate payments? Follow our step-by-step guides:

Additional Resources

Developer Documentation

- Authentication Guide - Set up secure API access

- Development Environments - Configure sandbox and production

- Request Signatures - Implement request signing for enhanced security

- Request Field-level Encryption - Protect sensitive data in transit

Support and Community

- FAQs - Common questions and troubleshooting

- Security Overview - Learn about our security practices and compliance

- Contact Banked Support for technical assistance or additional region